Join the next big thing. Unify, Simplify & Scale

Join the next big thing. Unify, Simplify & Scale

Best 6 Accounting Software In Kerala

Finance is the soul of all economic activities and it is considered as the lifeblood of business. Financial management indicates the management of inflow and outflow of financial resources in an enterprise. So as the driving force of a business enterprise it is the responsibility of every owner to maintain and control a firm’s financial activities optimally and efficiently .

In recent times it was so crucial and mundane to manage and supervise all the financial activities. With the advent of accounting software it is now easy to streamline the financial functions more precisely.

An accountancy software is a must for Small and Medium Enterprises (SME’s) in Kerala as its efficiency increases operations, enhances speed, and checks legal conformity. Business activities in Kerala include IT, agriculture and tourism business environment, thus requiring an effective Financial Management solution.

Accounting software include features such as accounting transactions, invoices, payroll and tax computation amongst others hence increases efficiency and reduces human error. In addition, it comes with real-time analytical tools to help business organizations make proper decisions based on current performance. Another advantage arises from the fact that being a state with a complex tax structure, it undergoes frequent changes, and software that updates automatically helps businesses to remain compliant.

Also, in a technologically progressing country like India especially in the state of Kerala where connectivity plays a paramount role accounting software enables employees to work remotely and collaborate which is essential keeping in mind the challenging environment needed for any business to sustain.

Hence, the purchase of the accounting software needs to be realized by most companies in Kerala in order for them to adapt to the strategies of their competitors, and remain buoyant in the face of severe financial setbacks.

That being the case let's explore the best 6 accounting software in Kerala at present.

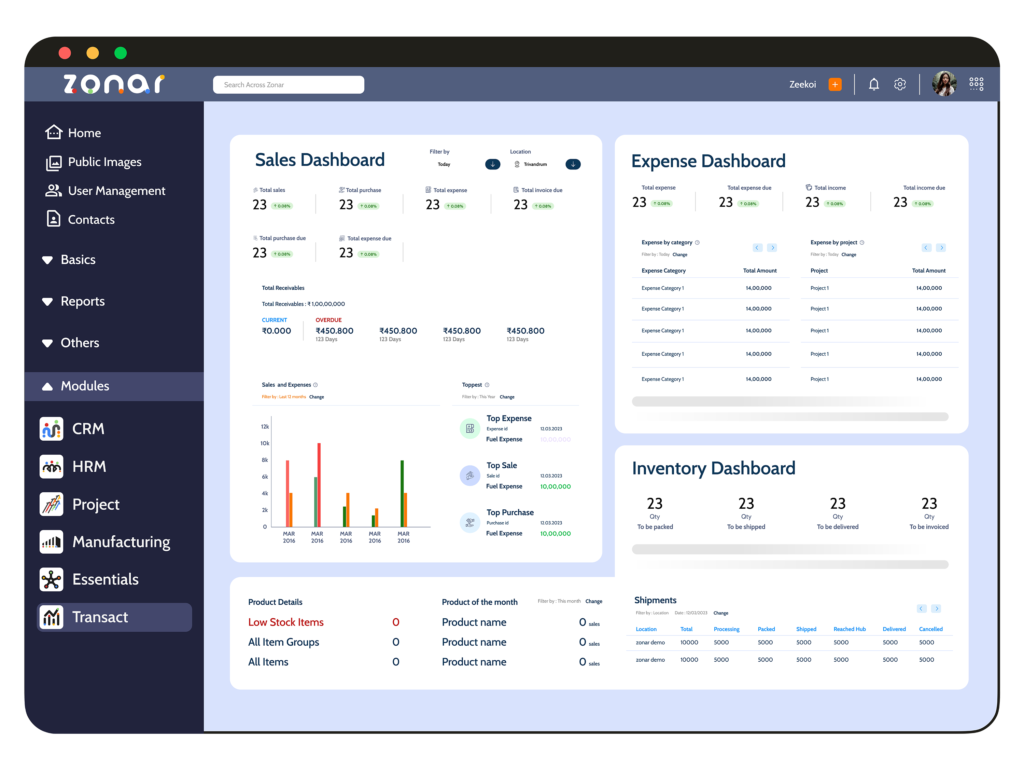

Zonar is a Saas Comprehensive ERP software solution for SME. Zonar unifies all crucial tools for a business in a single panel, It simplifies daily operations and what truly sets zonar apart is its scalability.The solution which features what SME precisely needs. They Can start from any module they want.Very easy to learn, without any support itself they can create any pay components, users anything based on their needs.

Zonar ERP specializes in an accounting software package for business management limitless to the knowledge in accounting. Its user interface is user friendly meaning that anyone can easily perform tasks such as issuing invoices, expenditure tracking, and making financial statements. A set of options is provided for configuring the software to fit certain requirements of a particular business without making it overly complicated.

Nonetheless, Zonar ERP has some features that enhance the interface and ensure that those using the system, even those who are not very computer literate, will find it easy to use the system. This does not mean that the software lacks important features essential for proper financial management since they are all present although they may not be as numerous as in the complex software.

Major Attributes Of Zonar Accounting Software

The following features collectively make ZONAR accounting software an indispensable tool for small businesses, simplifying financial management and allowing business owners to focus on growth and operations. So let’s dive in .

- User-Friendly Interface:

The layout of the software must in other words be easy to understand and operate hence conforming, conforming to the needs of the different categories of computer users. This makes it easily possible for those even those who have little knowledge on how to use the computer to learn how to use them. This is achieved through having a neat format of the document together with clear instructions that do not leave the user in a state of confusion when carrying out daily activities.

- Easy Handling:

It must decrease the level of complication in the accomplishment of accounting processes to ease the usage by the end users. The graphical user interface incorporating aspects such as drag and drop, templates and ‘smart’ form fill-ins make a lot of work easier. This elimination of complexity lowers the time taken to train the people and the small business persons can devote most of their time on managing their businesses rather than accountancy.

- No Financial Expertise Needed:

There is today accounting software that does not require much accounting knowledge to be used by the user. They also own guided setup, tutorials, and even a help center that will take a client through every aspect of the accounting process. The possibility of checking and calculation helps avoid common mistakes and does not require great initial financial training on the side of the users.

- Automated Bookkeeping:

This software has key activities of entering data, analyzing transactions, and balancing the accounts on a bank’s statements. This cuts on time spent on the manual bookkeeping work and it also reduces the number of mistakes made. Such features help to complement the reliability of financial records and financial data on the basis of which companies prepare financial analysis and financial statements.

- Invoicing and Billing:

Invoicing and billing systems help the users to create, transmit and track the invoices and bills within an organization. Different formats of invoices and paying bills with the help of automated notification remind the probable of timely payments. This feature supports several ways of payment and can also display the unpaid bills and can also display repeated bills to ease the accounts receivable.

- Expense Tracking:

It allows users to record and organize it effectively. The software assists the business in tracking its expenditure, finding out where the company could possibly reduce its expenditure, and later confirms that all the expenditures made are well captured.

- Financial Reporting:

There are financial reporting tools that give detailed expenses and this way analysts develop good number sense, that is seeing whether money is being spent well or not. It can consist of receipt scanning, a feature that categorizes them and automatic tracking of costs as they occur. provide different aspects of the business financial position for instance; income statement also referred to as statement of profit or loss, balance sheet and statement of cash flow. These reports can also be sectionalized and made to reflect a particular requirement; they are indispensable.

- Tax Management:

Tax functions include components that make the process of tax calculations, tax preparation, and tax filing easier. This software can also monitor the tax liabilities, the correct tax rates to apply, and generate any required tax forms. This makes sure that there is compliance with local tax laws and regulations and by doing so, minimizes the occurrences of wrong tax deductions, fines and audits. It sometimes includes automatic updates to the program codes to address changes in taxation laws so that businesses can meet the legal requirements at any one time.

- Integration Capabilities:

Operations with other applications, including CRM, payroll services, e-shops, and banking applications, are smooth and integrated into a single work setting. This integration avoids data overlaps and makes all the financial data to be available in one place. HHS heightens the quality by providing linkage between various systems and hence minimizing entities of data entry, which in turn increases efficiency of business information systems.

- Mobile Access:

Mobile tools enable clients to perform financial operations on the go with the help of their portable devices – mobiles or tablets. This is important for small business people since they will be able to run their businesses without always having to be anchored to a fixed desk. Features such as invoicing, expense tracking, and generating financial reports that are necessary for organizations’ daily operations can be easily done using the mobile apps.

- Data security and privacy

With zonar erp your data is in the safe hands, your security and privacy come first . by choosing zonar you get a seamless protected data and an expected approach towards your security and privacY. Zonar encrypts your customers’ sensitive personal and payment information.

Now from these we can sum it up that ZONAR ERP’s accounting software module is so relevant and convenient for the SME’s and profit drivers of new ventures as it provides a seamless and easy to handle accounting software making it the finest and leading software in Kerala.

Marg ERP is an acclaimed accounting software in the market for businesses and those established in Kerala specifically. Some of the services that one can expect to be provided by this Vendor Management System include inventory management, invoicing, and payroll services. Through Marg ERP you can also prepare some financial assessments like profit and loss account and balance sheet. Marg ERP has endless features that can be profitable for all types of businesses since it is easier to understand and implement it.

FEATURES OF MARG ERP

Stock management is quite impressive and I would like to remark that we had no problem finding the parts that we needed. Overall this software is good and easy to use when one has had experience with it. GST integration is very good, it saves the time of the accountant and the output of the ledge is matching to the GST portal.

Easy to integrate with Other APIs. AI functions are a big win nowadays.

Upgrade your business to super & higher level and look out the revolutionary Marg ERP difference by watching Marg ERP videos. Take your business to new heights of success by watching Marg ERP videos and experiencing the difference it can make.

Tally. ERP 9 is among the best accounting software used in the state of Kerala. It is convenient and can be adopted easily by every business. Tally. The new net release of ERP 9 includes the key services like inventory management, Payroll processing, and tax computation among others. It also enables it to produce management accounts and legislative requirements such as balance sheets and profit and loss accounts. Tally. inv-ERP 9 has both online and offline utility. With Tally.

THE EXISTING FEATURES IN THE NEW RELEASED ERP 9

Business owners can prepare and analyze the sales vouchers budgets in the manufacturing; on a daily, weekly, monthly, or yearly basis.

Owners of the businesses can easily generate purchase vouchers and view supplier wise details of the purchases.

The point of sale and ordering systems are integrated by virtue of Tally’s ERP software and the status of each order can be ascertained easily.

All aspects of a business are supported as well as all the functionalities for creating journal, payment, receipt and contra vouchers.

Besides, it includes proper inventory management; quick navigation to the business essential documents: budgets and controls; as well as security options.

QuickBooks is also one of the widely used accounting software in Kerala similar to Tally. specifically designed for small business and within it, has features like expense management, invoices and stock management. QuickBooks for its part also enables the preparation of financial reports like the profit and loss accounts and the balance sheet. This can operate online and offline. QuickBooks Enterprise helps you handle goods, instantaneous access to reports, sales, time, payroll, and additional inventory.

QuickBooks Enterprise assists organizations to present information that will be useful for the particular person who will be making a particular decision and in a format that will be easier for him to comprehend. As we shall also see, QuickBooks has managed to retain the established accounting features that placed it at the forefront whilst incorporating other robust tools needed for processing payroll and payments, tracking time, managing mobile employees and services, inventories, warehouses, and other tools related to an entity’s revenue. QuickBooks Enterprise is a robust, end-to-end management solution.

MAJOR ATTRIBUTES ARE POINTED DOWN

- Advanced reporting

- Advanced inventory

- Advanced pricing

- Assisted payroll

- Ecommerce integration

Arguably, transitioning from a variety of different software systems and Excel spreadsheets to a unified ERP software seems like an easy call but it is not. Licensing charges of software programs, and the requirement of re-training the employees can be strenuous for mid-size companies. It could be more advisable to include other features to a standard, widely used application, for example, QuickBooks that offer all the necessary capabilities.

Zoho Books is an online accounting software used for the business that fall under the small and medium category. It also has advantages such as an invoicing system, expense tracking, and project management. Zoho Books also provides creation of financial reports such as balance sheets and profit and loss accounts.

MAJOR CHARACTERISTICS

- Simplify receivables and streamline cash flow –Define the specifics of your receivables process and achieve stability of cash flow. Involution enables easy creation of invoices, allows for monitoring of payments and balances promptly.

- Buying on credit and its effective management-Education on how you can be on top of your money due to vendors. The payable section of the vendor management ensures the payment of bills, management of outstanding amounts and recording of any expense occurred.

- Manage Vendor Bills –Get in a position to have precise knowledge of your outstanding balances and correspondent relations. Of course, you can convert the vendor’s invoice to a bill, record full or partial payments, apply the vendor credits, and monitor all the payments made to the vendor more efficiently.

- Confirm transactions with the purchase approval- Manage them and pay your vendors on time by applying single or multi-level purchase approval to bills, purchase orders, and vendor credits.

- Integrate your bank with books- Zoho Books improves banking by allowing users to link their bank accounts and credit cards, download transactions, and match them with the general ledger for quick and effective closing of the month’s books.

Organize customers and vendors’ operations simply all over the world. It is essential not to use the wrong currency, language and format in transactions or letters and emails. Zoho Books for management of business beyond borders is developed to suit users from different parts of the world. First we prioritize the security and privacy of our users; hence, at Zoho what comes first is Zoho users security. This way, Zoho Books provides you with the combination of powerful data security and compliance with the highest levels of privacy regulation.

There are numerous accounting software available in the market and some of the frequently used accounting software in Kerala are Busy Accounting Software. This software is suitable for small and medium enterprises and covers different functions in the organization’s work, including invoicing, stock control, and payroll. Even more, Busy Accounting Software enables the creation of balance sheets and the determination of profits and losses.

Micro,Small & Medium enterprise billing and accounting software is known as Busy. It is quite easy to use but at the same time it is quite robust and customizable according to the size and nature of your business operations. BUSY Software is also in Desktop, Cloud and Mobile App version.

FEATURES OF BUSY ERP

- Complete GST Management- For all the simplification required for GST compliance for your business, BUSY is the organization to go for. Some of the functions in this software are GST invoicing, GST filing and return, Auto e-way bill & e-invoices, GST reconciliation, GSTIN verification and still more.

- Financial Accounting- Struggling to manage your money and your budget? Get rid of your financial accounting woes with BUSY and hasten the sending of detailed income and expenses statements. In this package a complete book of accounting, reporting and analysis, bank reconciliations, and sales and purchases analysis are included.

- Inventory management- Similarly to GOS, BUSY Software comes with the extensive set of inventory management tools that allow having the full control over your inventory and its visibility to properly perform usual activities connected with ordering, creating new quotations and challans, as well as creating invoicing documents.

- Mobile Application- The prospect of having full authority in one’s hands though they are away from their desk is another advantage of BUSY Mobile Application because it allows sales and stocks and purchases and cash/bank and receivables & payables records to be done anywhere and at any time even when the BUSY Desktop is off. This application enables the customers to download over one hundred reports and manage receipts, orders, invoices, and quotations.

- Operations management- BUSY covers everything that gets you busy because it consolidates all the activities that require you to use different tools. One can effectively handle business activities like having more than one branch, salary disbursement, customer relations, management of a discount program, manufacturing and contracting work easily with the help of this software.

Another choice of business accounting software is the Busy accounting software which the business users can adjust depending on the business requirements.

Thus, based on different partners of BUSY solution partners, you can use add-ons and extensions for boosting the performance of the software aggressively. From the BUSY accounting software, there is the newly launched application called BUSY App for the Android and iPhones.

Specifically, it is the perfect mobile accounting application solution designed for existing BUSY users who can easily connect with Busy accounting software and make and share invoices and quotations; capture orders as well as receipts from any location at any time and access 100+ reports.

Conclusion

Finally, it is possible to conclude that the importance of choosing Zonar ERP accounting software cannot be overemphasized for SMEs. Due to its simplicity and customizations, the clear structure, and easy access, Zonar ERP allows small and medium businesses to get a great multifunctional tool for their accountants. Due to its simple design and basic math skills that are not very complicated, it is suitable for business people and teams. The solutions offered by Zonar ERP include work and process management, automation of certain tasks, and providing reliable data to enhance serious manufacturing SMEs’ business and organizational development.

In addition, when it comes to capacity the solution is well devised in the sense that as organizations grow, the Zonar ERP system will have the capacity to grow with it hence being a sustainable solution to help business organizations achieve their goals and objectives. All in all, the act of selecting Zonar ERP accounting software provides the small business with necessary tools to grow and ensure the continuity of its activity in the context of modern competition. However, many accounting software products are available in Kerala to meet the requirement of different sizes of businesses. In the current technological scenario, ZONAR erp which is a leading accounting software suits and deals with your business requirements from all aspects.

Tranformed

1800+

Imagine Your Business, Your Way.